Posted by

Development

in

Business Intelligence

on

Monday, January 12, 2009 4:24 PM

In the current economic climate, businesses are likely to encounter conditions which will threaten the health and viability of operations. Exposure to such conditions will probably cause a decrease in the demand for products and services and cause an increase in operating costs. As a response, decision makers could place a renewed emphasis on lean management principles and undertake cost cutting measures (ie. seeking staff redundancies) . To further protect the bottom line, decision makers may also seek to extend supply terms (creditor days) in anticipation of higher inventory days and slower collection of receivables.

In this example, the impact of the current economic climate is modelled using Analysis-One (

www.analysis-one.com). Using the Analysis-One forecast tool, we are able to model the likely impacts of changes to key business drivers and generate a view of forecast financial performance.

We will assume the following adverse impacts will affect performance:

Adverse Factors

| Prices will be forced down |

-4 % |

| Volumes of sales will decrease |

-6 % |

| Cost of Sales will increase |

+3 % |

| Debtors will pay slower |

+15 Days |

| Inventory will be held longer |

+20 Days |

We can also assume that management will undertake the following mitigating steps in response:

Mitigating Factors

| Creditors will be paid later |

+10 days |

| Staff will be retrenched |

-10 % |

| Overheads will be cut |

-5 % |

| Funding costs will decrease |

-4 % |

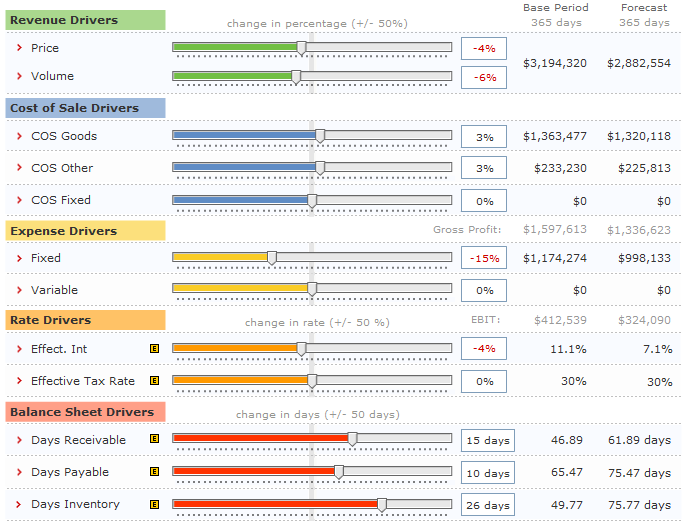

Screenshot : analysis-one forecasting tool

Using the Analysis-One forecast tool (see screenshot), we are able to model the impact of these assumptions on key performance indicators (see table below).

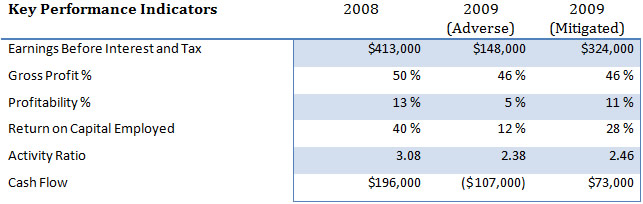

In this example, we clearly see the impact of the adverse factors on performance, while also considering the potential effect of efforts undertaken to mitigate these adverse factors.

Modelling allows management to plan for reduced demand and rising costs and to predict the impact on profitability and cash flow. Importantly in this modelling scenario we are measuring the impact on Key Performance Indicators (KPIs) such as EBIT, Gross Profit %, Profitability % (income statement), while also considering the impact on cash flow and funding (balance sheet).

Accurate and timely modelling is a powerful tool for decision makers and businesses in the current economic climate.